The Pros and Cons of Credit Cards: How to Choose the Best One for Your Lifestyle

Understanding the Financial Tool of Credit Cards

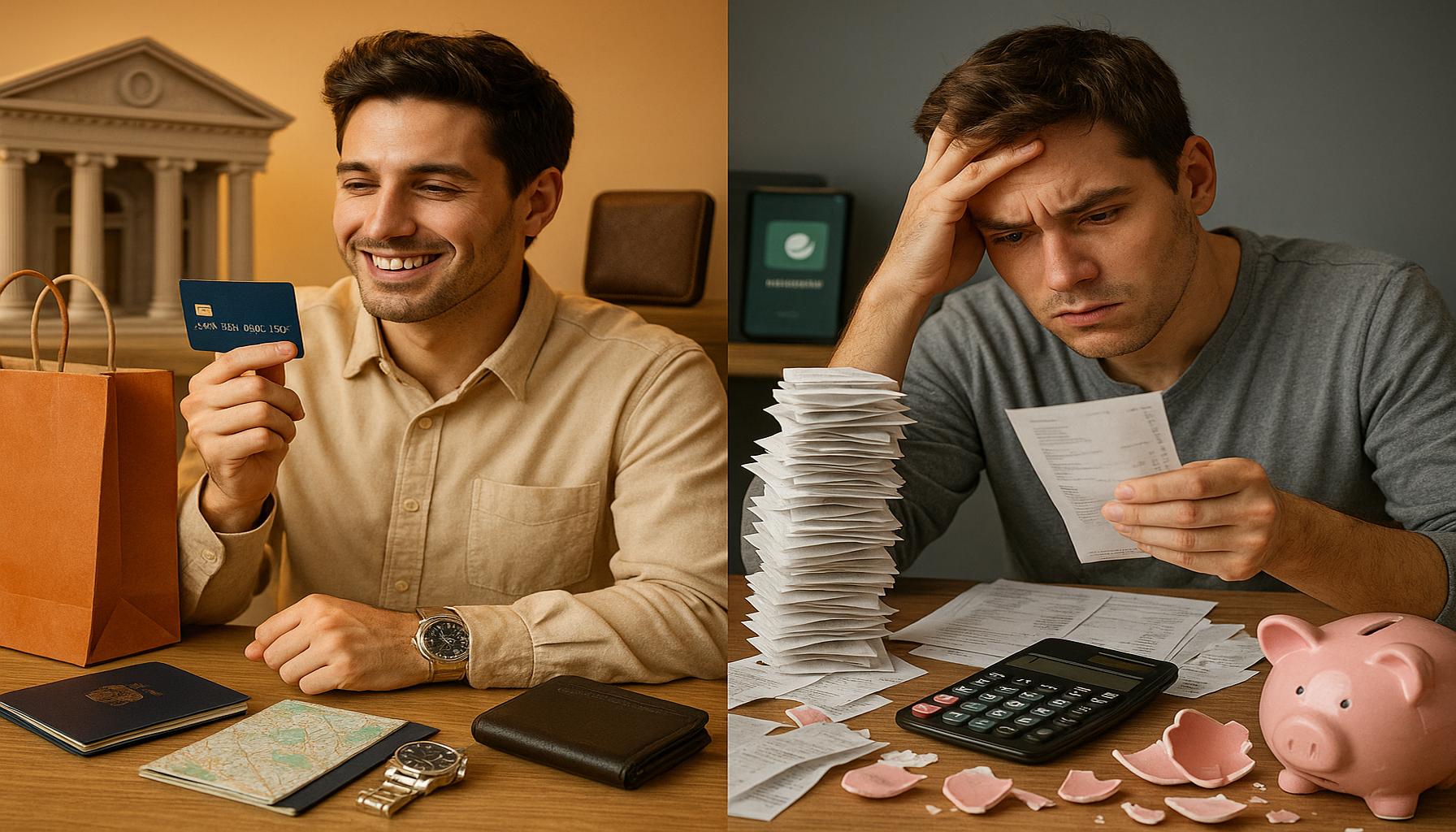

In today’s fast-paced world, credit cards can be both a blessing and a burden. They offer convenience and benefits but also pose risks that can lead to financial stress if not managed responsibly. Understanding the pros and cons of credit cards is essential for making informed decisions that align with your lifestyle. The right approach to using credit can empower you to achieve financial independence and security.

Advantages of Credit Cards

- Building credit history: One of the most significant benefits of using credit cards responsibly is the ability to establish and build your credit history. A good credit score is essential for significant financial milestones, such as applying for a mortgage or a car loan. Regular, on-time payments can reflect positively on your credit report, giving you better rates on loans in the future.

- Rewards and cash back opportunities: Many credit cards offer an array of rewards and cash back options that can be highly beneficial, especially if you use your card for everyday purchases. For instance, cards like the Chase Freedom Unlimited provide cash back on grocery purchases, travel, and dining, transforming ordinary spending into extraordinary savings. Imagine planning a family vacation paid for entirely by cash back rewards!

- Emergency purchasing power: Life can be unpredictable, and having a credit card can provide a financial safety net in times of need. Whether it’s an unexpected car repair or medical expense, a credit card can give you the flexibility to manage unplanned costs without derailing your other financial commitments.

Challenges of Credit Cards

- High-interest rates on unpaid balances: One of the most significant drawbacks of credit cards is the potential for accumulating high-interest charges on outstanding balances. With rates often exceeding 20%, carrying a balance can quickly spiral into significant debt, making it vital to pay off your card in full each month whenever possible.

- Potential for debt accumulation: Without careful monitoring, credit cards can lead to overspending and excessive debt accumulation. This temptation can be especially high for individuals who may be just starting to establish their credit and may not fully grasp the long-term implications of high balances.

- Fees and penalties for late payments: Missing payments can lead to hefty fees and an increase in interest rates, further complicating your financial obligations. Staying organized and setting reminders can help avoid these pitfalls, ensuring that your credit card remains a tool for empowerment rather than a source of stress.

Choosing the right credit card can significantly enhance your financial journey. By evaluating your lifestyle and spending habits, you can find a card that aligns with your values and promotes responsible usage. Moreover, educating yourself about the terms and features of different cards can protect you from unfavorable conditions.

As you embark on this financial exploration, remember to weigh your options carefully. Discover the best features and benefits that suit you while steering clear of common pitfalls. With the right card in your wallet, you can take control of your finances, paving the way for a brighter fiscal future. Embrace the journey toward financial literacy and responsibility; the rewards of wise credit card management can fuel your dreams and enhance your quality of life.

DIVE DEEPER: Click here to unlock your savings potential

Navigating the Benefits and Risks of Credit Card Usage

When it comes to managing personal finances, understanding the advantages and challenges of credit cards is paramount. With the right knowledge and approach, these financial tools can serve not only as a means of payment but also as a pathway to greater financial stability and rewards. However, it is equally important to recognize the potential pitfalls that can accompany their use.

Maximizing the Advantages

Credit cards have evolved beyond simple purchasing power; they can enrich your financial life when used wisely. Here are some key advantages to consider:

- Convenience: The immediacy of credit cards allows you to make purchases without carrying cash. Whether you are buying groceries or booking travel plans, having a credit card can streamline these transactions, making your life a little easier.

- Extended warranties and purchase protection: Many credit cards offer benefits beyond mere cash back or points; they come with added protections such as extended warranties on purchases and fraud protection. This means that if something goes wrong with a purchase, your credit card’s issuer may have your back, adding an extra layer of security to your spending.

- Travel benefits: For frequent travelers, certain reward cards provide perks that can enhance your journey, such as travel insurance, airport lounge access, and no foreign transaction fees. These benefits can transform your travel experiences, making them not just enjoyable but also affordable.

Acknowledging the Challenges

Despite the many benefits they offer, credit cards present several challenges that must be approached with caution. Understanding these risks is crucial to maintaining a healthy financial life:

- Compounding interest rates: If not managed carefully, the cost of carrying a balance can dramatically increase due to high-interest rates. Not only can this lead to financial strain, but it can also hinder your ability to pay off debts quickly. Hence, it’s vital to approach credit card usage with a repayment strategy to avoid falling into the debt trap.

- Fees: Many credit cards come with annual fees, late payment fees, and even balance transfer fees. These additional costs can eat into any rewards you might earn, which makes it important to assess whether a credit card’s benefits outweigh its fees.

- Impact on credit score: While using a credit card can help build your credit history, mismanagement—such as making late payments or maxing out your credit limit—can hurt your credit score. This could affect your chance of securing loans or lower interest rates in the future, dictating the need for responsible card usage.

As you weigh the advantages and challenges of credit cards, it is essential to reflect on your unique financial habits and goals. By embracing the benefits while staying alert to the potential downsides, you can make informed decisions that will strengthen your financial future. Remember, the key lies not just in choosing the right card, but also in committing to a disciplined approach to credit management that serves your lifestyle and aspirations.

DISCOVER MORE: Click here to find out how to apply

Choosing the Right Credit Card for Your Financial Lifestyle

As you consider credit cards, it’s essential to align your choices with your unique financial habits and aspirations. The key is to understand which credit card features resonate most with your lifestyle, goals, and spending patterns. Below are some important factors to guide you in selecting the optimal credit card for your needs:

Understand Your Spending Habits

Every individual has distinct spending habits that can greatly influence which credit card will be the most beneficial. Do you find yourself dining out frequently or shopping for clothes? If so, you might want a card that offers higher cash back or reward points in those categories. Many credit cards offer cash back rates of up to 5% on specific purchases; thus, aligning your card rewards with your spending can help you maximize returns.

Evaluate Rewards Programs

Reward programs vary drastically among credit cards, and understanding these could lead to significant savings or benefits. Are you someone who enjoys traveling? Look for cards that offer travel rewards, point systems, or partnerships with airlines and hotel chains. Some cards allow you to accumulate points for flights, hotel stays, or even brand-specific gift cards. Remember, not all rewards are created equal; read the fine print to ensure that the redemption process is simple and attainable for you.

The Importance of Introductory Offers

Many credit card issuers entice new customers with attractive introductory offers, such as zero percent APR for the first few months or bonus points for first purchases. These offers can be highly beneficial if you have big purchases planned or intend to transfer a balance from a higher-interest card. However, assess the long-term interest rates that kick in after the introductory period concludes; some attractive rates explode into substantially higher ones, therefore, do not merely chase that initial bait.

Rewards vs. Interest Rates

It’s easy to get excited about accumulating rewards points; however, you should also keep a close eye on the Annual Percentage Rate (APR). If the interest rates are sky-high, the benefits you gain from rewards can be eclipsed by unpaid interest if you carry a balance. Analyze your financial habits—if you regularly pay off your balance in full each month, a rewards card could be beneficial. On the other hand, if you sometimes carry a balance, it may be wiser to choose a card with a lower interest rate and minimal fees instead of a lavish rewards structure.

Know Your Credit Score

Your credit score plays a pivotal role in determining which credit cards you can qualify for, as well as the terms associated with those cards. Before applying, check your credit score so you can target cards that suit your credit profile. Many credit cards offer easier approval for individuals with lower credit scores, though they may come with higher fees and rates. Meanwhile, premium cards available to those with excellent credit often feature the best rewards and offers, making it important to be aware of where you stand.

Ultimately, the best credit card for you is not solely based on flashy rewards or zero interest rates; it’s a holistic reflection of your financial lifestyle. With careful evaluation of your spending habits, an understanding of various cards’ offerings, and a keen awareness of your financial responsibilities, you can turn your credit card into an empowering tool that serves your goals rather than a source of anxiety.

DISCOVER MORE: Click here to learn how to create a retirement plan

Final Thoughts on Credit Cards and Financial Empowerment

In the journey of personal finance, credit cards can serve as powerful allies or daunting obstacles, depending on how you approach them. As we’ve discussed, understanding your financial habits, evaluating rewards programs, and being mindful of interest rates are crucial elements in selecting the card that best suits your lifestyle. Choosing a credit card is not just about the lure of rewards; it’s about fostering a responsible relationship with credit that empowers your financial wellbeing.

By aligning your credit card options with your spending patterns and financial objectives, you create an opportunity for not just savings, but for long-term financial health. Consider the importance of your credit score as a vital puzzle piece in this process, which helps tailor your search to the cards that will offer you the most advantageous terms. Remember, the right credit card can enhance your lifestyle while safeguarding your financial future.

As you explore your options, remain conscious of your spending behaviors, and resist the temptations of immediate rewards that could overshadow ongoing financial responsibilities. Keeping a clear perspective will not only help you make informed choices but will also pave the way toward achieving your broader financial goals.

In essence, the quest for the perfect credit card is a step toward financial empowerment. Embrace this journey with diligence and awareness, turning your credit card into a tool that enhances your life rather than complicating it. Take charge of your financial future today—your empowered decisions will lead to lasting success.

Related posts:

Apply for Bank of America Travel Rewards Credit Card Easily Online

How to Easily Apply for HSBC World Elite Mastercard Credit Card

How to Apply for Preferred Cash Rewards Visa Signature Credit Card

How to Apply for the USAA Advantage Credit Card Step-by-Step Guide

How to Apply for Capital One Spark Miles Credit Card Effortlessly

How to Apply for M1 Owners Rewards Credit Card Step-by-Step Guide

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.